How Taxi Drivers Can Maintain a Clean Record to Lower Insurance Costs

For taxi drivers, maintaining a clean driving record is more than just a point of pride—it’s a crucial factor in keeping insurance costs down. This is especially true for those needing PCO insurance for taxi drivers, where even minor infractions can lead to significant premium increases. Fortunately, there are several proactive steps taxi drivers can take to ensure their records remain spotless. In this article, we’ll explore the top five strategies that can help taxi drivers maintain a clean record and, as a result, enjoy lower insurance costs.

Practice Defensive Driving

Defensive driving is one of the most effective ways to avoid accidents and keep your record clean. This involves being aware of your surroundings, anticipating potential hazards, and making safe driving decisions. For taxi drivers who spend hours on the road daily, defensive driving techniques such as maintaining a safe following distance, adhering to speed limits, and being cautious at intersections can significantly reduce the risk of accidents. By avoiding collisions and traffic violations, you can protect your driving record and wallet.

Take Advantage of Safe Driver Training

Many insurance companies offer discounts to drivers who complete safe driving courses. These courses provide valuable tips and techniques for avoiding accidents and improving driving skills. For taxi drivers, enrolling in a safe driver course enhances your ability to navigate the roads safely and demonstrates to insurers that you are committed to maintaining a clean record. This proactive approach can lead to lower premiums and better overall driving performance.

Before you can begin your journey towards financial freedom, take a moment to really assess your current financial situation and understand how you got there in the first place. Ask yourself some important questions: What are your spending habits like? Are you prone to impulsive purchases or excessive indulgence? Do you have a clear budget in place, or do you tend to spend without thinking about the consequences? It’s crucial to be honest with yourself during this process. Acknowledge any negative patterns or behaviors that may have contributed to your debt accumulation. This self-reflection will help you gain insight into your relationship with money and identify areas for improvement.

Before you can begin your journey towards financial freedom, take a moment to really assess your current financial situation and understand how you got there in the first place. Ask yourself some important questions: What are your spending habits like? Are you prone to impulsive purchases or excessive indulgence? Do you have a clear budget in place, or do you tend to spend without thinking about the consequences? It’s crucial to be honest with yourself during this process. Acknowledge any negative patterns or behaviors that may have contributed to your debt accumulation. This self-reflection will help you gain insight into your relationship with money and identify areas for improvement.

One of the key benefits of having a forex broker is access to market information. Forex brokers have access to up-to-date market data and can provide traders with valuable insights into events that could affect their trading decisions. This can prove invaluable in making educated guesses on how markets will move and where prices might go. Additionally, having access to market data and trends can help traders determine entry and exit points for forex trades.

One of the key benefits of having a forex broker is access to market information. Forex brokers have access to up-to-date market data and can provide traders with valuable insights into events that could affect their trading decisions. This can prove invaluable in making educated guesses on how markets will move and where prices might go. Additionally, having access to market data and trends can help traders determine entry and exit points for forex trades.

Another common reason why people take out payday loans is to consolidate their debt. They can be used to pay off other debts, and this can help reduce loan payments and the overall amount of interest being paid. By consolidating debt into one loan, people can save a lot of money in the long run.

Another common reason why people take out payday loans is to consolidate their debt. They can be used to pay off other debts, and this can help reduce loan payments and the overall amount of interest being paid. By consolidating debt into one loan, people can save a lot of money in the long run.

The first and most important thing you should look for in a crypto exchange is security features. It is because exchanges are often targets for hacking attempts. Some of the things you should look for include two-factor authentication, anti-phishing measures, and insurance. Two-factor authentication (or two-step verification) is an extra layer of security that requires you to confirm your identity using two different factors.

The first and most important thing you should look for in a crypto exchange is security features. It is because exchanges are often targets for hacking attempts. Some of the things you should look for include two-factor authentication, anti-phishing measures, and insurance. Two-factor authentication (or two-step verification) is an extra layer of security that requires you to confirm your identity using two different factors.

One of the most common mistakes people make when

One of the most common mistakes people make when

One of the most important things to consider when getting a car loan is the interest rate. The interest rate will determine how much you’ll ultimately pay for your car, so it’s important to shop around and compare rates from different lenders. Some lenders offer high-interest rates to lure customers in, so be sure to read the fine print before signing on the dotted line. Many have fallen into the trap of agreeing to a high-interest rate without realizing it, so be sure you know what you’re getting yourself into.

One of the most important things to consider when getting a car loan is the interest rate. The interest rate will determine how much you’ll ultimately pay for your car, so it’s important to shop around and compare rates from different lenders. Some lenders offer high-interest rates to lure customers in, so be sure to read the fine print before signing on the dotted line. Many have fallen into the trap of agreeing to a high-interest rate without realizing it, so be sure you know what you’re getting yourself into.

There are often when you might need to give your employees their paychecks. But, what usually happens is that they will be sent to the wrong address or there could be other errors in the mailing details which would lead them back to you for rectification. This causes further delays and frustration on the part of your employees and you because you have to deal with them. However, this is not the case when you use a paystub generator as it takes care of all these details itself and sends the correct information directly into your employees’ bank accounts.This would mean that there will be no errors at any point in time because the data which goes through a paystub generator is all verified and there are no chances that it would go wrong.

There are often when you might need to give your employees their paychecks. But, what usually happens is that they will be sent to the wrong address or there could be other errors in the mailing details which would lead them back to you for rectification. This causes further delays and frustration on the part of your employees and you because you have to deal with them. However, this is not the case when you use a paystub generator as it takes care of all these details itself and sends the correct information directly into your employees’ bank accounts.This would mean that there will be no errors at any point in time because the data which goes through a paystub generator is all verified and there are no chances that it would go wrong.

Consider starting with choosing a lender that has all the necessary paperwork. If you deal with an unlicensed lender, then you can land into problems. It is essential to research the best lender that best suits your requirements for your loan. Checking if the company has a valid license to operate as a credible lender will help you build trust in dealing with the best professionals.

Consider starting with choosing a lender that has all the necessary paperwork. If you deal with an unlicensed lender, then you can land into problems. It is essential to research the best lender that best suits your requirements for your loan. Checking if the company has a valid license to operate as a credible lender will help you build trust in dealing with the best professionals.

Most borrowers recommend quick loans because the procedure of applying is straightforward. On the other hand, once you have met all the requirements set, the approval process is speedy. However, before applying for any loan, borrowers are asked to read the terms and understand them.

Most borrowers recommend quick loans because the procedure of applying is straightforward. On the other hand, once you have met all the requirements set, the approval process is speedy. However, before applying for any loan, borrowers are asked to read the terms and understand them.

Small businesses and even more individual entrepreneurs do not have such a robust budget to keep

Small businesses and even more individual entrepreneurs do not have such a robust budget to keep

One of the limiting factors in studies is time. You have to meet deadlines to perform well and finish your assignments on time. However, you may not always

One of the limiting factors in studies is time. You have to meet deadlines to perform well and finish your assignments on time. However, you may not always

will not allow you to operate without this insurance, and even if you are in a state that does allow it, customers want you to have it. In today’s economy and environmental management, businesses and homeowners ask to see proof of liability insurance before allowing you to set foot on the project site.

will not allow you to operate without this insurance, and even if you are in a state that does allow it, customers want you to have it. In today’s economy and environmental management, businesses and homeowners ask to see proof of liability insurance before allowing you to set foot on the project site.

One of the main reasons why many people prefer to use Bitcoin is that it allows discretion. Unlike traditional currency, one can pay or do a business transaction with Bitcoin without worrying about others knowing. With the conventional mood of paying like the use of credit cards, a trail is left behind. Anyone with access to your financial provider can see the transaction that you have made.

One of the main reasons why many people prefer to use Bitcoin is that it allows discretion. Unlike traditional currency, one can pay or do a business transaction with Bitcoin without worrying about others knowing. With the conventional mood of paying like the use of credit cards, a trail is left behind. Anyone with access to your financial provider can see the transaction that you have made. The second reason why people prefer Bitcoin is …

The second reason why people prefer Bitcoin is …

Unlike auto loans, mortgages and student loans which have to go to specific uses, personal loans, except for a few cases, can be used for a variety of purposes. You could take these loans for paying …

Unlike auto loans, mortgages and student loans which have to go to specific uses, personal loans, except for a few cases, can be used for a variety of purposes. You could take these loans for paying …

Once you identify the right type of account that you need, make sure that you think about accessibility. When it comes to financing, note that convenience is a critical factor that you need to put into consideration. If you want to pick the right financial institution in Kenya, make sure that you find one that is easily accessible. In doing this, it will be easier to meet your business …

Once you identify the right type of account that you need, make sure that you think about accessibility. When it comes to financing, note that convenience is a critical factor that you need to put into consideration. If you want to pick the right financial institution in Kenya, make sure that you find one that is easily accessible. In doing this, it will be easier to meet your business …

You can actually wait and see that your credit score has improved after many years. That is if you also stop your bad credit habits. If you see no reason why you have to rush …

You can actually wait and see that your credit score has improved after many years. That is if you also stop your bad credit habits. If you see no reason why you have to rush …

Many payday companies require some minimum income report for your request to be considered. Some lenders prefer that you should have at least some cash from steady contracts. Many lenders can also ask the company you are working in to prove that your papers are right. If, in any case, they notice or spot any forged or false information, your request will not qualify for a payday loan.

Many payday companies require some minimum income report for your request to be considered. Some lenders prefer that you should have at least some cash from steady contracts. Many lenders can also ask the company you are working in to prove that your papers are right. If, in any case, they notice or spot any forged or false information, your request will not qualify for a payday loan.

Value investing makes you take a different thought and action from the other investors. The decisions made in value investing will rely on the actual data on the ground. You will be able to evaluate and analyze data on the ground to come up with new strategies that will be of benefit to your clients. Value investing does not, therefore, involves making decisions based on people’s feelings about the trends in the market.

Value investing makes you take a different thought and action from the other investors. The decisions made in value investing will rely on the actual data on the ground. You will be able to evaluate and analyze data on the ground to come up with new strategies that will be of benefit to your clients. Value investing does not, therefore, involves making decisions based on people’s feelings about the trends in the market.

This is one of the essential things you need to consider before you apply for your loan. Make sure that there is transparency over the interest and charges for borrowing a payday loan. However, with payday loans, you will quickly notice that their charges will be displayed on a specific website. Also, it is recommended to check for the default charges or late payment fees should you miss …

This is one of the essential things you need to consider before you apply for your loan. Make sure that there is transparency over the interest and charges for borrowing a payday loan. However, with payday loans, you will quickly notice that their charges will be displayed on a specific website. Also, it is recommended to check for the default charges or late payment fees should you miss …

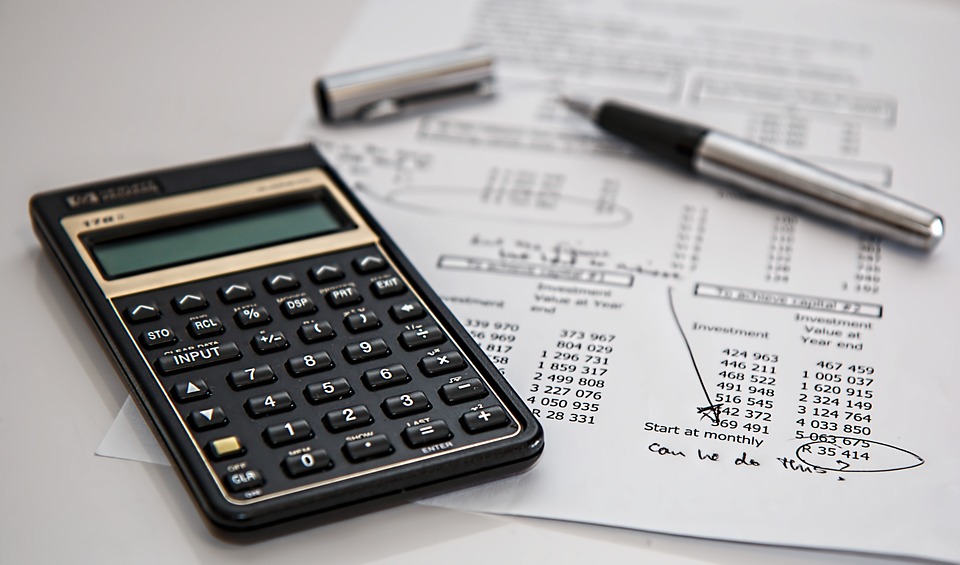

How many high-interest loans do you have? Accumulate the interests and compare the result with your annual income. Does your salary cover the payment?

How many high-interest loans do you have? Accumulate the interests and compare the result with your annual income. Does your salary cover the payment?

Spiritually, there is only One.

Spiritually, there is only One. The changing of Mankind is about the realization of Oneness with God. Looking past …

The changing of Mankind is about the realization of Oneness with God. Looking past …